New Massachusetts Legislation Allows Unemployment Income Deduction - April 6, 2021

New legislation signed into law by Governor Charlie Baker on April 1, 2021, allows taxpayers with household income of not more than 200% of the federal poverty level to deduct up to $10,200 of unemployment benefits from their taxable income on their 2020 and 2021 tax returns. This amount is applicable to each individual; however, because the Massachusetts income threshold differs from the federal income threshold (a deduction of up to $10,200 if the taxpayer’s federal adjusted gross income is less than $150,000) some taxpayers may be eligible for a deduction on their federal tax return but not on their Massachusetts tax return.

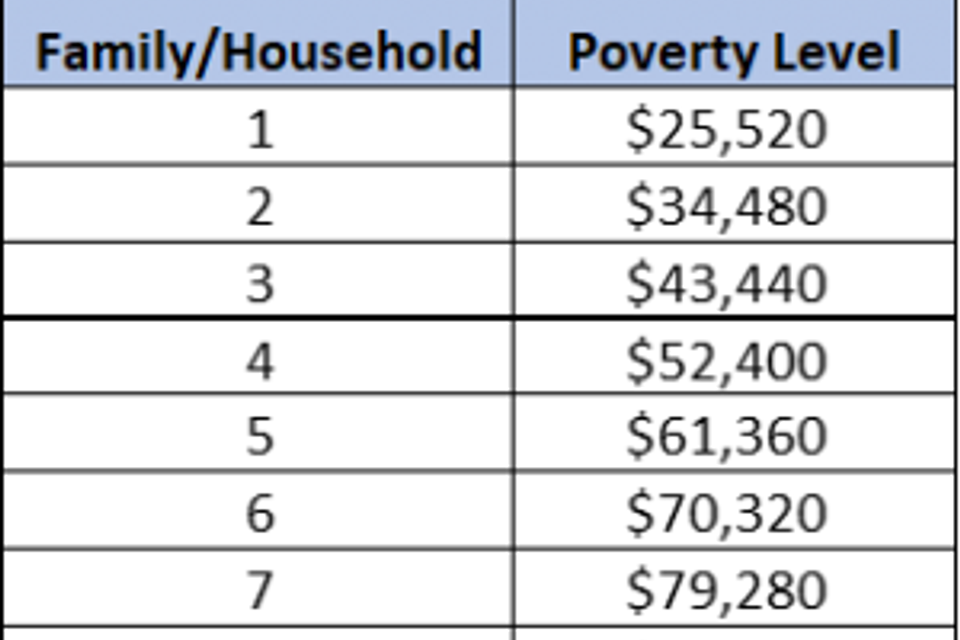

On its Tax Filing Season Frequently Asked Questions web page, the Massachusetts Department of Revenue provided the following with regard to income limits based on 200% of the federal poverty level:

For families/households with more than 8 persons, add $8,960 for each additional person.

On its Tax Filing Season Frequently Asked Questions web page, the Massachusetts Department of Revenue provided the following with regard to income limits based on 200% of the federal poverty level:

For families/households with more than 8 persons, add $8,960 for each additional person.