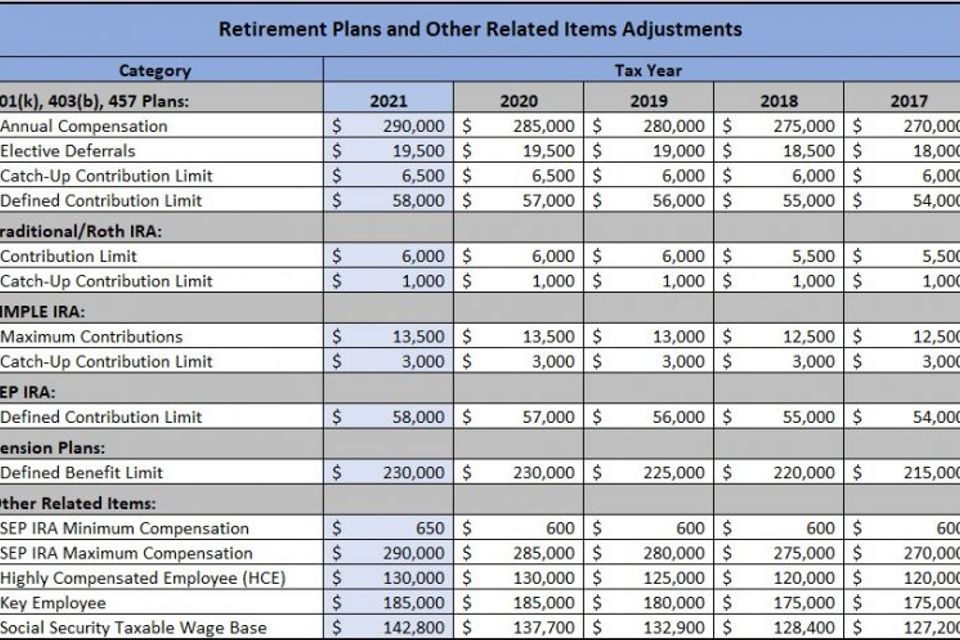

Annual Compensation – The maximum compensation that can be considered in calculating defined contribution profit-sharing, money purchase plans , SEP IRA allocations, and defined benefit plan accruals.

Elective Deferral Limit – The maximum annual pre-tax contribution a participant can make to a 401(k), 403(b), or 457 government plan.

Catch-Up Contribution Limit– The amount that persons age 50 and over can make in addition to elective annual contributions.

Defined Contribution Limit – The maximum annual contribution that can be added in a plan year to a participant’s employee pre-tax, employer matching, and employer profit-sharing accounts (a/k/a Annual Additions).

Defined Benefit Plan Limit – The maximum annual benefit that can be paid to a participant under a traditional employer-based retirement program. Often the benefit is based on factors such as the participant’s salary, age, and the number of years employed. The limit applied is the lesser of the defined benefit plan limit and the average compensation over the three consecutive calendar years during which the employee had the greatest aggregate compensation.

Highly Compensated Employee – An individual who:

Owned more than 5% of the interest in the business at any time during the year or the preceding year, regardless of how much compensation that person earned or received, or

For the preceding year, received compensation from the business of more than $130,000 and, if the employer so chooses, was in the top 20% of employees when ranked by compensation.

Key Employee – Any employee (including former or deceased employees), who at any time during the plan year was:

An officer making over the amount specified ($185,000 in 2021 Tax Year);

A 5% owner of the business (a 5% owner is someone who owns more than 5% of the business), or

An employee owning more than 1% of the business and making over $150,000 for the plan year.

SEP IRA – Simplified Employee Pension plan that is treated like traditional IRAs for tax purposes and allow the same investment options. The same transfer and rollover rules also apply. Employer contributions to a SEP IRA cannot exceed the lesser of:

25% of the employee’s compensation, or

$58,000 for 2021 ($57,000 for 2020).

Social Security Taxable Wage – The amount from which Federal Insurance Corporation Act Taxes (FICA) are deducted.